Perhaps one of the most confusing aspects of getting a mortgage is knowing who you actually pay once the thing funds. And to that end, when your first mortgage payment is due.

While Bank X may have closed your loan, an entirely different company could send you paperwork and a payment booklet. What gives?

Well, this highlights the difference between a mortgage lender and a mortgage servicer.

The former funds your loan and the latter collects payments each month thereafter until the loan is paid off.

Sometimes it’s the same company, sometimes it’s not, assuming your loan is sold off after closing.

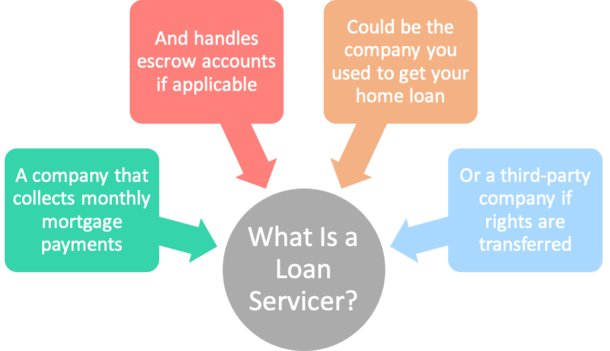

As noted, a mortgage loan servicer, also known simply as a loan servicer, is the company that collects your monthly mortgage payments once the loan funds.

Each month, you will send payment to this company, which could go on for 30 years depending on how long you keep your loan.

They will also manage your escrow account if your home loan has impounds, collecting a portion of property taxes and homeowners insurance each month, before making those payments on your behalf when due.

So really, there’s a good chance you’ll deal with your loan servicer a lot more than your mortgage lender, who may have only been in the picture for a month or so while your loan was originated.

You see, many mortgage lenders focus on loan origination as opposed to servicing. This means they fund loans, quickly sell them off for a profit, then rinse and repeat.

The same goes for mortgage brokers, who fund your loan on behalf of a wholesale mortgage lender, which also may sell off the loan to a different servicing company shortly after it closes.

Further complicating all this is the fact that your mortgage lender could also be your loan servicer because some big banks and mortgage companies can profit from it.

So it’s possible that Bank X could also be your loan servicer once the loan funds. In this case, you’d deal with the same company from origination to loan payoff, many years down the road.

As a rule of thumb, nonbank lenders typically sell off their mortgages, while depository banks often hold onto them. This comes down to basic liquidity, as it can be expensive to retain large loans.

One thing mortgage companies figured out in recent years was that keeping in touch with their past customers was a great way to generate repeat business. Or cross-sell other services.

If they sell all their home loans off to other companies, they may lose out if mortgage rates fall and these customers become ripe for a mortgage refinance.

There are also mortgage subservicers, third-party companies that perform loan servicing tasks on behalf of a lender, instead of handling those things in-house.

Anyway, without getting too convoluted here, it’s important to note this distinction between lender and servicer so you know who you’re dealing with.

And to ensure you’re sending monthly mortgage payments to the right place!

The list above should give you a better idea of what loan servicers do, and why banks and lenders may choose to outsource these tasks.

It’s essentially a completely different business than mortgage lending, and one many lenders aren’t equipped to handle.

Perhaps the simplest way to look at it is lenders fund loans, and loan servicers manage loans.

If you have any questions regarding your home loan post-closing, it’s generally best to get in touch with your loan servicer as opposed to your mortgage broker or lender.

They should be able to answer any questions you have, whether it’s knowing where to send payments, how to make extra payments or biweekly mortgage payments, loan amortization questions, and so on.

Additionally, if having payment troubles in the future, your loan servicer should be the one to call to discuss options.

Remember, the lender is typically just there to help process and close your loan, then hands off the reins to a servicer from there.

In a nutshell, it comes down to money. Doling out hundreds of millions of dollars in loans can get expensive. And if you’re not a big bank with lots of assets, liquidity will run dry pretty quickly.

This means focusing on the loan origination aspect of the business, and selling the mortgages off to another company or investor to free up capital.

The process is known as originate-to-distribute, with the loans not kept on the books of the lenders themselves.

Instead, the loans are quickly sold off to investors and/or packaged into mortgage-backed securities (MBS) a month or two after funding.

This allows the lender to continue originating more loans, without worrying about holding millions in mortgages.

It also means they can focus on loan origination as opposed to loan servicing, which is an entirely different business.

A company might be good at actual mortgage lending, but not be well equipped to deal with servicing loans over long periods of time.

As noted, it’s pretty common for mortgages to be sold shortly after loan origination. Obviously this can be aggravating, and also confusing. Who do you pay!?

The same thing can happen periodically throughout the life of your loan, perhaps years into it.

So your loan might be sold immediately after it funds, then resold five years later to another servicer.

It can change hands several times during the life of the loan, depending on how long you keep it.

The good news is your old and new loan servicer must notify you when transferring servicing rights to your loan.

The old servicer should send notice at least 15 days before your loan’s servicing rights are transferred to the new servicer.

And the new servicer should also send notice within 15 days after the servicing rights for your loan are transferred.

Sometimes these notices can be combined if your loan is sold off immediately after origination, with your original lender directing you to the new servicer.

But they must spell out important details including the date on which your old servicer will stop accepting payments, and when your new servicer will begin accepting payments.

The new servicer’s company name and contact information must be included, along with the specific date the right to service your loan transferred to the new servicer

One of the most important things to do after your mortgage funds is to take note of who your loan servicer is.

Unfortunately, mortgage servicing rights are frequently transferred shortly after your loan funds, which can make it confusing to know who to pay.

Add in all the junk mail you might receive as a new homeowner (like mortgage protection insurance) and it could get really murky.

The good news is lenders and loan servicers must adhere to certain rules regarding the transfer of servicing rights.

After your mortgage funds, look out for a letter in the mail from the entity that closed your loan regarding a servicing transfer. You may also receive a letter from your new loan servicer as well.

It should clearly explain who will be processing your mortgage payments going forward, and is required to be sent 15 days prior to your loan’s servicing rights being transferred to the new servicer.

The letter should include all the relevant contact information you’ll need to ensure payments are sent to the right company at the right time.

Take note of when they’ll begin accepting payments, and when the old company will stop accepting payments.

In my opinion, it doesn’t hurt just to call the company and make sure everyone is on the same page before you send your payment, just to avoid a mess.

If you do make a payment mistake, there are some protections in place if it’s within 60 days of the servicing transfer, per the CFPB.

During this time, the new loan servicer can’t charge you a late fee or mark the payment as late if your payment was sent to your old servicer by its due date or within the grace period.

The answer is a little bit of yes and no. But mostly no. Allow me to explain.

As noted, home loans are often sold off shortly after they fund. However, there are some banks and lenders that retain their loans and/or service them.

So if you get your loan from one of these companies, you’ll effectively also select your loan servicer too.

One example is Navy Federal, which services all their loans throughout the loan term. This means you’ll deal with them before your loan funds and after, which can be nice.

But I don’t know if it makes sense to pick a lender simply because they’ll keep the loan, especially if their pricing is higher.

It’s also possible that they’ll hold onto the loan initially, then sell it in the future. So there’s really no guarantee what happens long-term.

Conversely, some mortgage companies sell all their loans. So you’ll know upfront that they won’t be your servicer.

Either way, you don’t have too much control here unless you select a company that retains all servicing rights and manages loans in-house.

I’ve had a loan be sold then resold back to the original company that held it.

1. Rocket Mortgage

2. Guild Mortgage

3. Chase

4. Bank of America

5. Huntington National Bank

6. New American Funding

7. Regions Mortgage

8. CrossCountry Mortgage

9. Citizens Mortgage

10. Caliber Home Loans (owned by Newrez)

Rocket Mortgage was the highest-ranked mortgage servicer in 2023, per the latest U.S. Mortgage Servicer Satisfaction Study from J.D. Power.

In a close second was Guild Mortgage, followed by Chase, Bank of America, and Huntington National Bank.

This list relates to the loan servicers that provided the highest level of customer satisfaction, thanks to being helpful, answering questions, solving problems, and keeping customers informed.

Both USAA and Navy Federal actually have higher rankings than all the companies listed above, but don’t meet the survey’s award criteria.

In other words, you should have a very good customer experience with those two companies as well.

These are listed in alphabetical order since I don’t have figures available to rank them by total servicing volume. But they are some of the largest mortgage servicers in the country.

Remember, big doesn’t necessarily mean good. It just means they are substantial players in the space.

All of these companies service billions of dollars in home loans for customers, which they either originated themselves or acquired from other banks and mortgage lenders.

If you have a mortgage, there’s a good chance one of the companies on this list handles your loan servicing.

Tip: Always take the time to make sure you’re actually dealing with your loan servicer and not some phony entity.

Before creating this site, I worked as an account executive for a wholesale mortgage lender in Los Angeles. My hands-on experience in the early 2000s inspired me to begin writing about mortgages 18 years ago to help prospective (and existing) home buyers better navigate the home loan process. Follow me on Twitter for hot takes.

Latest posts by Colin Robertson (see all)