A fund flow statement reveals the periodic increase or decrease in a business enterprise's funds.

The statement reflects the efficiency of financial management staff in generating funds from various sources and applying them to generate income without sacrificing the company's financial health.

The flow of funds refers to the transfer of economic value from one asset to another, from one equity to another, from one asset to equity, or from one equity to other assets (or a combination of any of these).

The term 'flow' indicates change, and hence, a fund flow refers to a change in funds or a change in working capital.

Funds flow into working capital from the sources of funds, which include trading profits, issue of shares and/or debentures, borrowings, sale of fixed assets, repayment of borrowings, payment of tax, dividends, and increase in working capital.

Hence, the difference between the sources and application of funds shows the net change in the working capital during the year/period.

It is only those items that affect the net working capital of the business that find a place in this statement.

Thus, a fund flow statement is a financial statement that reveals the methods by which the business activities have been financed and how the enterprise has used its funds between the opening and closing balance sheet dates.

This is only a supplementary statement to 'time-honored statements (i.e., income statement and position statement, or balance sheet).

The fund flow statement describes the sources from which additional funds were generated and the areas or items to which these funds are used or applied.

In a nutshell, transactions that increase working capital are sources of funds, whereas transactions that decrease working capital are applications of funds.

From the perspective of information users, the statement helps in understanding how efficiently funds are procured and how effectively the funds are employed.

In general, financial statements such as balance sheets and profit and loss accounts, popularly known as income statements, focus on the net effect of various transactions on the operational and financial position of the company.

Thus, the balance sheet is a statement of an organization's assets and liabilities between two points in time.

The assets side of the balance sheet shows the development of resources in a company, whereas the liabilities side indicates its payments to outsiders.

The profit and loss account shows the income and expenditure of an accounting period (generally one year). Thus, these two statements show the financial highlights of the company.

A third statement is prepared to show changes in assets and liabilities from the end of one period to the end of another period. This statement is known as the financial position or fund flow statement.

A fund flow statement is a statement that shows the movement of funds and reports an enterprise's financial operations. It shows the various means by which funds are obtained and used.

Several definitions of fund flow statements have been proposed in the past.

According to Robert N. Anthony, "A fund flow statement describes the sources from which additional funds were derived and the uses to which these sources were applied."

ICWA defined fund flow statements as either prospective or retrospective, and it was noted that they set out the sources and application of funds.

The purpose of the statement is to indicate how funds are raised and how the same have been used.

Yorston, Smyth, and Brown defined as fund flow statement as follows: "A fund flow statement is prepared in summary form to indicate changes (and trends) are prepared regularly."

Lastly, according to Foulke, a fund flow statement is "a statement of sources and application of funds. designed to analyze the changes in the financial conditions of a business enterprise between two dates."

A fund flow statement shows the various means by which funds have been obtained and used in a business over a specific period. As such, such a statement is a statement of a firm's cash inflows and cash outflows.

To further highlight the term "funds", note that there are commentators who view funds as cash or working capital, which represent the excess of current assets over current liabilities.

To prepare a fund flow statement, list the receipts from assets and liabilities on the sources side and the payments for assets and liabilities on the application side.

To do this, we need a balance sheet at the beginning and end of the accounting period for which a fund flow statement is prepared. The two ways of presenting fund flow statements are shown below.

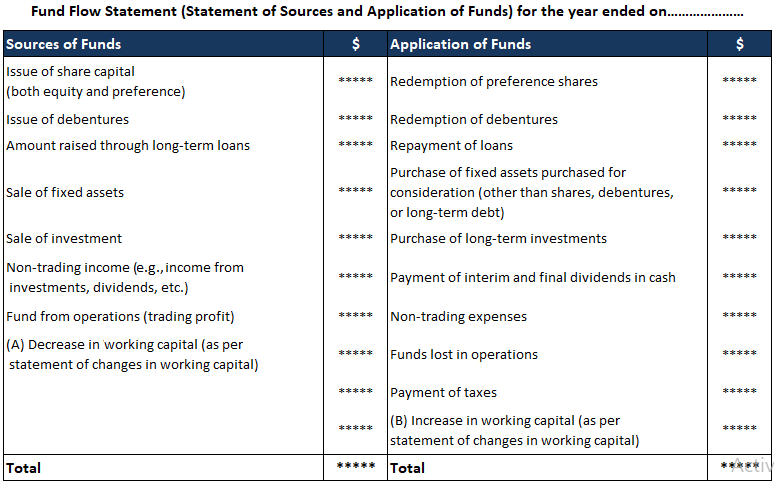

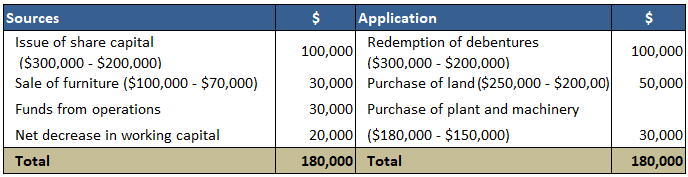

T-Format of Fund Flow Statement

Note: Either (A) or (B) will appear in the T-format.

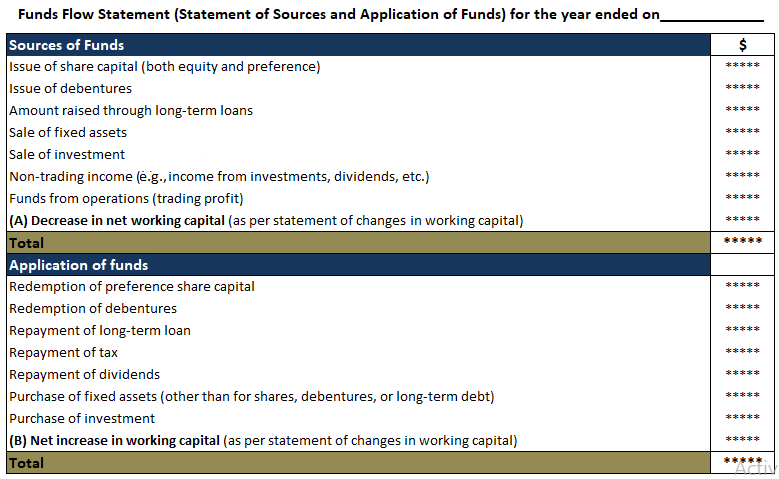

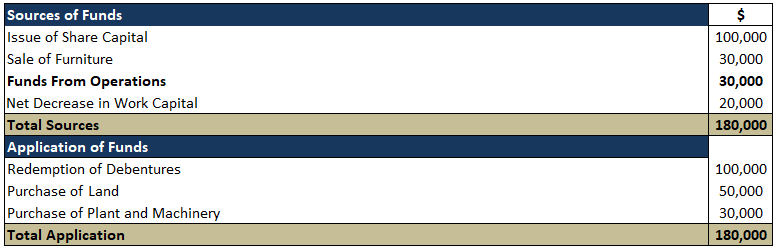

Vertical Format of Fund Flow Statement

Note: Either (A) or (B) will appear in the statement.

The main objectives and uses of the fund flow statement are as below.

1. Knowledge of financial position. The fund flow statement indicates the addition in profits, which is a boon to shareholders. The division of profit can be planned.

2. Knowledge of addition in share capital. The fund flow statement can highlight changes in share capital.

3. Knowledge of addition or reduction in share premium. The fund flow statement shows the fluctuation in share premium.

This increases when shares are issued at premium or when preferential shares or debentures are reduced and the statement shows key information at a glance.

4. Knowledge of profit or loss of operation. The fund flow statement clearly shows whether an organization is earning profit or sustaining a loss.

5. Knowledge of addition in long-term borrowings. The statement can show the additional amount borrowed by issuing debentures.

6. Knowledge of decrease in working capital. The statement shows the reduction in working capital (i.e., when current assets are less than current liabilities).

7. Fund flow statement acts as a guide. The statement allows management to learn about future problems, needs, and fundraising requirements, helping the company to avoid financial problems.

8. Helpful in sound dividend policy. Sometimes, a company may have sufficient profit, yet it is advisable not to distribute dividends for lack of cash or liquidity. The fund flow statement is useful in informing sound dividend policy.

9. Helpful in long-term borrowings. Before advancing long-term loans, financial institutions may ask for several years of fund flow statements to learn the firm's creditworthiness.

10. Useful information for investors. Before investing, some investors study a company's fund flow statements to know how funds are raised and used (e.g., whether funds are adequate for the payment of interest and principal sum).

11. Other uses of fund flow statements:

The main limitations of fund flow statements are the following:

1. Does not substitute for an income statement or balance sheet. Fund flow statements provide additional information regarding changes in working capital. They are not replacements for income statements or balance sheets.

2. Cannot indicate why capital is raised or redeemed. Although cash inflows and outflows are shown in a fund flow statement, no information is given about the reasons for these.

3. By-product of a financial statement. As a matter of fact, a fund flow statement is simply a rearranged statement of financial data.

4. Based on historical data. Fund flow statements are historical in nature as they are the outcome of old financial data, which are simply a window dressing.

5. Potentially misleading. Fund flow statements can sometimes be misleading, especially when an analyst does not know the reality and soundness of the figures from which they are computed.

| Balance Sheet | Fund Flow Statement | |

| 1 | Shows the assets and liabilities of an enterprise at the end of the accounting period | Shows the changes in assets and liabilities of an enterprise during an accounting period. |

| 2 | Prepared on a particular date at the end of the accounting period | Prepared for a specific accounting period. |

| 3 | Prepared with the help of trial balance and additional information provided | Prepared with the help of balance sheets of two years and additional information |

| 4 | Purpose is to reveal the financial position of a business on a particular date | Purpose is to facilitate decisions about investing activities |

| 5 | Static in nature as it shows assets and liabilities on a particular date | Dynamic in nature as it reveals changes in the amount of assets and liabilities (and the reasons for the same) |

| 6 | Businesses are statutorily obligated to prepare balance sheets | Preparation of fund flow statements is optional |

| 7 | Profit and loss account is prepared before preparing a balance sheet | Schedule of changes of working capital is prepared before preparing the fund flow statement |

| 8 | Limited utility for decision-making | Regularly used by management for financial analysis and decision-making |

| Schedule of Changes in Working Capital | Funds Flow Statement | |

| 1 | Prepared with current assets and current liabilities only | Prepared with both current and non-current assets and liabilities |

| 2 | Prepared as part of a fund flow statement | Not prepared as part of a statement of changes in working capital |

| 3 | Shows changes in current assets and current liabilities individually | Shows the sources and application of funds of an enterprise as a whole |

| 4 | Prepared using balance sheets from two consecutive accounting periods | Prepared using profit and loss accounts and balance sheets from two consecutive accounting periods |

| 5 | Prepared to understand the movement of working capital | Prepared to show an enterprise's overall operational efficiency |

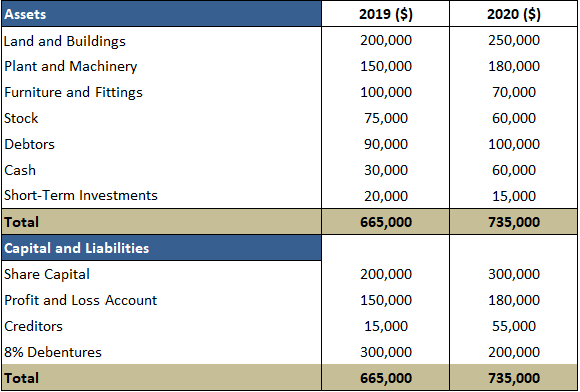

From the following balance sheets of Kites Limited, prepare a statement of changes in working capital and fund flow statement.

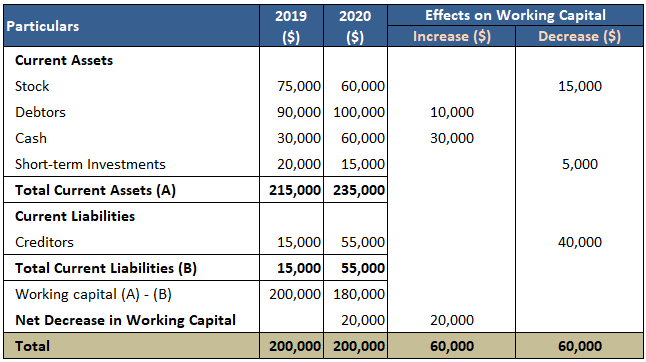

Statement of Changes in Working Capital

Note: Net decrease in working capital is entered in the increase column to balance the statement.

Fund Flow Statement

Alternatively: Statement of Sources and Application of Funds

The fund flow statement is a Financial Statement that reveals the sources and application of funds for an enterprise over a period of time. It shows changes in capital during an accounting period, including cash inflows and outflows related to financing activities, investment activities, and operating transactions.

A fund flow statement is prepared regularly by management to understand and ascertain the overall operational efficiency of an organization. It helps in decision-making such as whether to liquidate liquid assets (e.G., Selling a stock for cash) or use it further.

To prepare a fund flow statement, list the receipts from assets and liabilities on the sources side and the payments for assets and liabilities on the application side. To do this, we need a balance sheet at the beginning and end of the accounting period for which a fund flow statement is prepared.

The main objectives and uses of the fund flow statement are: - knowledge of financial position - knowledge of addition in share capital - knowledge of addition or reduction in share premium - knowledge of profit or loss of operation - knowledge of addition in long-term borrowings

The main limitations of fund flow statements are the following: - does not substitute for an income statement or balance sheet - cannot indicate why capital is raised or redeemed - by-product of a Financial Statement - based on historical data - potentially misleading

About the Author

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Content sponsored by 11 Financial LLC. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from 11 Financial upon written request.

11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

© 2024 Finance Strategists. All rights reserved.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.