- Using two “authorised signatories” as defined in the Companies Act 2006 as every director and the company secretary (but note that one individual who is both director and company secretary may not count as two authorised signatories);

- Using one director’s signature, which must be witnessed; or

- By affixing its common seal (this is not common in practice).

2. If an individual signs on behalf of the company, what evidence of authority should I see?

A properly appointed director will generally have at least implied authority to sign a contract on behalf of a company so long as the contract relates to the company’s ordinary course of business. Check by means of a Companies House search that the individual is a duly appointed director. If the individual who signs is not a director, you should obtain a copy of written authority. Such authority must be given by the board of directors, rather than an individual director, so an extract from board minutes will suffice. In the absence of written authority, the document will be validly executed if there was implied or ostensible authority (but clearly written authority is best to put the matter beyond doubt).

3. The agreement is to be executed as a deed – how does the company execute?

- By the company itself signing (including electronic signing). It can do this in one of three ways:

- using two “authorised signatories” defined in the Companies Act 2006 as every director and the company secretary (but note that one individual who is both director and company secretary may not count as two authorised signatories);

- using one director’s signature, which must be witnessed; or

- by affixing its common seal (this is not common in practice).

Note that electronic signatures are permitted for both contracts and deeds. This is confirmed by the Law Commission’s report on the electronic execution of documents dated September 2019. If the company signs using two authorised signatories, this can be achieved by each of the two authorised signatories signing the deed (using an electronic signature or other acceptable method) either in counterparty or by one authorised signatory signing, followed by the other adding his or her signature to the same version (electronic or hard copy) of the deed. If a company signs using a director plus witness, the Law Commission’s view is that the current law probably does not allow for “remote” witnessing such as by video link, so any witness would have to be physically present with the signatory.

Note also that specific formalities are required for deeds by virtue of the Law of Property (Miscellaneous Provisions) Act 1989. They must be in writing, it must be clear on the face of the deed that it is a deed, it must be validly executed by the company (see above) and it must be delivered (see more below). Delivery can be achieved through electronic signing but care must be taken to make clear when delivery takes place.

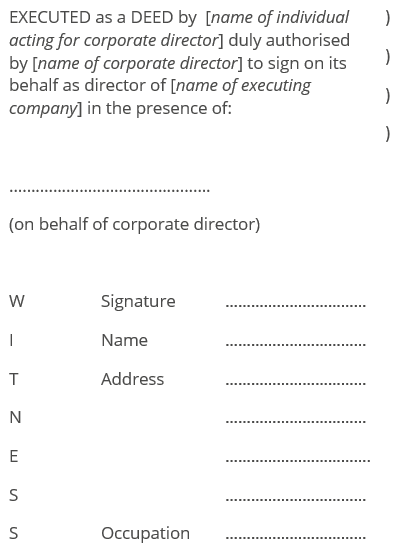

If the company has a corporate director note that where there are references in a document to it being signed by a corporate director, it is read (section 44(7) of the Companies Act 2006) as references to it being signed by an individual authorised by the firm (i.e. the corporate director) to sign on its behalf. Suggested execution clause is:

4. How does an individual enter into a written contract, or a deed?

Simply by the individual signing the written contract, or by an agent signing on behalf of the individual. Note that a document or deed may be validly executed using electronic signatures (see question 3 above). Authority given by an individual for another person to sign a document on his or her behalf does not need to be given by power of attorney, unless the document in question is a deed.

5. How does an individual execute a deed?

By signing the document in the presence of a witness who sees the individual sign and then attests the signature by adding witness details to the execution block. Conventionally, the witness will sign his or her own name, and complete details of name and address for ease of identification should due execution be queried at some stage in the future. Note that the requirements for individuals to execute deeds apply to individuals if they execute in their capacity as trustees or as partners in a partnership, for example. Electronic signatures are permitted, both for the signatory and for the witness, but the Law Commission has stated that the witness should be physically present with the signatory and genuinely observe the signing (rather than via a live televisual medium).

6. Who can validly witness a signature?

The purpose of a witness is to provide evidence of proper execution in the event that it is later queried. The witness must be physically present when the document is signed so that he or she can attest that he or she was present and saw the document being signed. The witness should sign immediately after the signatory has signed. There is no legal requirement to print the witness’s name and address, but this is helpful in tracing the witness if due execution is later queried.

A party to the deed may not be a witness. However there is no statutory requirement for the witness to be independent, simply that he or she can provide unbiased evidence that the document was properly executed.

7. What are the execution requirements if one or more of the parties is incorporated overseas?

The execution provisions of the Companies Act 2006 applicable to companies incorporated in England and Wales apply to overseas companies with modifications. Agreements (including deeds) may be executed by such a company:

- by the company affixing its common seal;

- in any manner permitted by the laws of the territory in which the overseas company is incorporated; or

- by the signature of a person who is acting under the express or implied authority of the overseas company (as determined by application of the laws of the territory in which it is incorporated).

If a document purports to have been signed in accordance with one of the above three methods, there is a statutory presumption in favour of a purchaser in good faith for value that the document has been validly executed. Nevertheless, best practice is to obtain an opinion from local counsel in respect of the applicable execution requirements in the relevant overseas jurisdiction.

8. What do I need to check if documents are signed under a power of attorney?

The power of attorney must be executed as a deed by the donor. Note that the execution provisions that apply for an attorney are the same as if the attorney was signing as principal, so the formalities for a company executing a document as attorney will be as described above in question 3.

Check the wording of the execution block. It should be along the lines of “signed as a deed by [name of attorney] acting by [names of two directors, or one director plus secretary; alternatively one director provided the signature is witnessed] [a director/the secretary] as attorney for and on behalf of [name of principal] [under a power of attorney dated [date]]”.

Check the terms of the power of attorney, in particular whether the attorney has powers to agree amendments to transaction documentation. Note that an express power to delegate must be included in the power of attorney if the attorney has purported to delegate power.

9. Is one signatory able to sign in different capacities if necessary?

Note that if the document is to be signed by a company under section 44(2)(a) of the Companies Act 2006 (by two authorised signatories), one individual who is both director and company secretary may not count as two authorised signatories.

10. Do special rules apply for particular documents, such as those to be filed at the land registry or HMRC?

The Land Registry has its own prescribed way of executing documents – see Practice Guide 8 and Practice Guide 9.

Note that a stock transfer form does not need to be executed as a deed. However, for a corporate transferor of shares, it is preferable that it executes by using the company’s signature under one of the two methods permitted by section 44 (2) (a) or (b) (i.e. by two authorised signatories or by a director with a witness – see answer to question 3 above).

The information contained in this guide is intended to be a general introductory summary of the subject matters covered only. It does not purport to be exhaustive, or to provide legal advice, and should not be used as a substitute for such advice.

© Stevens & Bolton LLP 2020.