Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

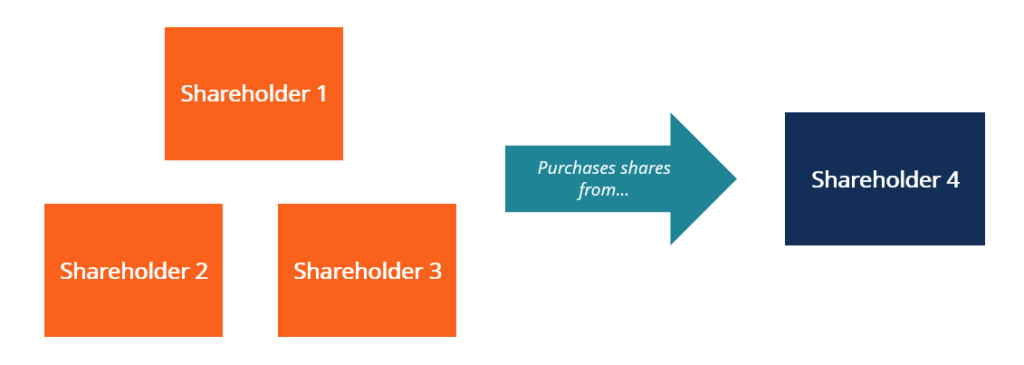

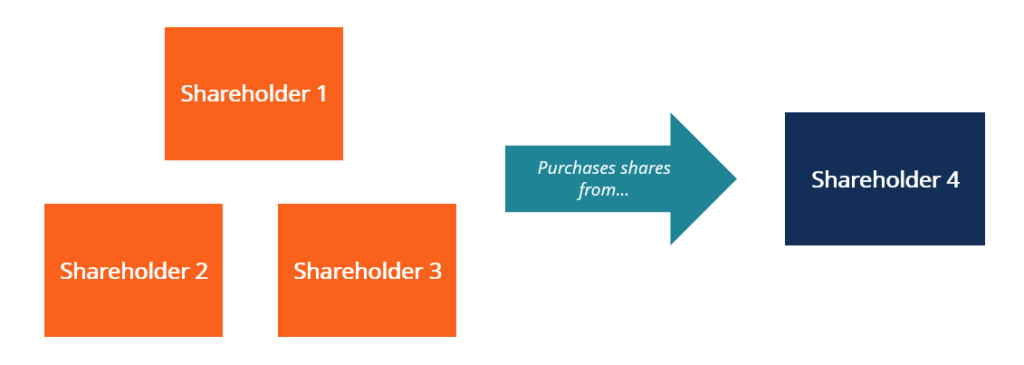

A cross purchase agreement is when a company’s shareholder or business partner agrees to purchase the shares of another shareholder or business partner who leaves the company due to death, retirement, or incapacitation.

Before the shareholder or business partner leaves the company, they would agree to let their shares be sold to other shareholders or business partners. The purpose for an organization to put in place such an agreement is to be able to ensure business continuity and the smooth transition of ownership to others who are still part of the company.

When creating a cross purchase agreement, it is important to consider the number of existing partners or shareholders and how many shares each individual will purchase. The age of existing partners and shareholders and their ability to fund the purchase should also be considered when entering into a cross purchase agreement.

Existing business partners or shareholders are given the option to purchase the shares of those who leave the company. Purchases must be personally funded, which is often challenging to resource, especially when there is an unexpected death, incapacitation, or early retirement of the departing party.

A solution to ensure there are adequate funds is to make the shareholders and business partners purchase life insurance policies for other partners and shareholders in the company name themselves as the beneficiary of the insurance policy.

The premium for the policies will be paid out of their own pockets. When a partner or shareholder leaves the company due to death, retirement, or incapacitation, the proceeds of the insurance policies will go towards purchasing his/her shares at a predetermined price.

Individual A and individual B enter a cross purchase agreement. As a result, A and B both purchase life insurance policies for each other. The beneficiary for A’s life insurance is B. Alternatively, the beneficiary for B’s life insurance is A. Both of them pay a premium for the insurance policy they purchased.

Suppose that A passes away, which means that A’s ownership of the company will be transferred to B.

A’s shares will be sold to B under the predetermined price specified in the cross purchase agreement. B uses the proceeds from the life insurance policy to pay for A’s shares.

A cross purchase agreement allows a smooth transition of ownership from departing partners or shareholders to others in the company. The transfer of ownership through the proceeds from life insurance is not subject to income tax.

The company does not include the value of the life insurance policies on its financial statements because the insurance policies are owned personally by the individual, not by the company. As a result, the value of the company will not be overstated.

Proceeds from the life insurance policies cannot be accessed by the company’s creditors.

If there are many shareholders or business partners in a company, it will increase the complexity of implementing the cross purchase agreement. It requires the purchase of a large number of insurance policies.

For example, if there are ten shareholders in a company and there are three shareholders who are leaving due to retirement, then the remaining shareholders will hold a total of 30 insurance policies.

If there are shareholders or business partners who are a lot younger in age than other shareholders or business partners, they will need to pay a larger premium when purchasing life insurance.

Proceeds from the life insurance policies are not considered to be the company’s assets.

CFI is the official provider of the Capital Markets & Securities Analyst (CMSA)® certification program, designed to transform anyone into a world-class financial analyst.

In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful:

From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.